When it comes to trading, futures are financial contracts to buy or sell an asset at a specified date in the future for a fixed price.

It is a financial asset that is part of the derivatives market, which means that the contract takes the value of a separate asset: shares, commodities, indexes or cryptocurrencies; and subsequently, through speculation, a price that it could be in the future is agreed upon.

At the beginning of monetary exchange, goods were often bartered or "traded" in exchange for payment. Over time, buyers of goods realized that they needed some goods throughout the year, but not right away.

The concept of futures trading was originally created in the 19th century under the name of "forwards" or "futures market", with the aim of protecting raw material producers in periods of concentrated supply (harvest) and in a market with highly variable prices throughout the year, which made the work unattractive.

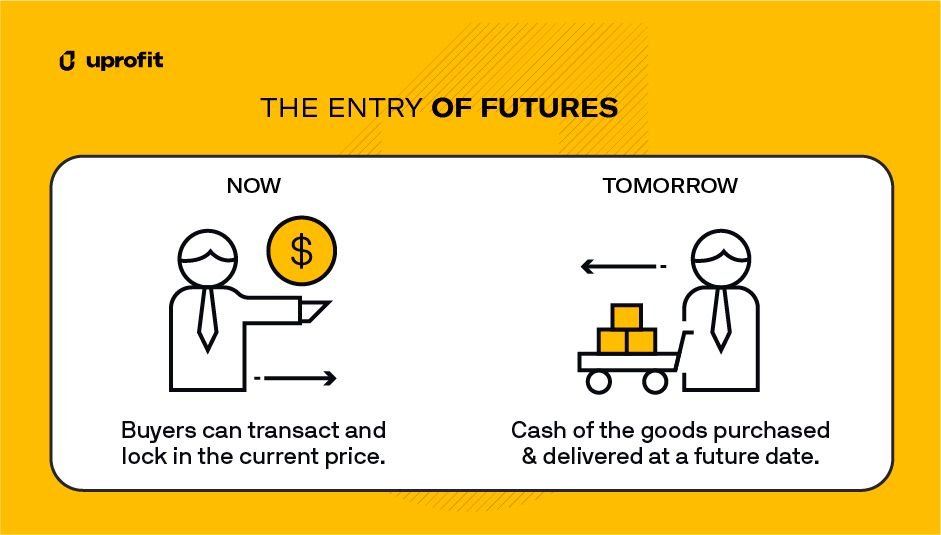

The entry of futures into the market allowed buyers to transact in the present while allowing them to cash in on the goods purchased at a later date. Buyers could lock in the current price for goods delivered at a future date.

This new trading practice also benefited sellers. Sometimes, sellers were not yet ready to dispose of their items.

This is when futures trading became really useful, as it allowed sellers to lock in a price for a future sale. In short, both sellers and futures buyers were able to limit their price risk.

Trading futures involves transacting these contracts in relation to the asset being traded.

The buyer of the contract is obliged to take possession of the underlying on which it is agreed once it reaches its expiration date. However, while the contract is ongoing, the buyer can sell his position and free himself from the obligation.

Types of Futures Trading

When trading futures, there are many opportunities to trade in different markets, as well as to trade different contract sizes. This last variation is thanks to the creation of standard, e-mini and micro e-mini futures.

The main feature of mini and micro futures trading is that they allow a trader to operate in the futures market for a fraction of the capital required by standard contracts. Because of their volatility, micro futures are a great option to consider when trading.

Regarding the types of futures trading, there are different kinds of contracts that take their value from various financial assets or underlying products:

- Futures stock indexes.

- Crude oil futures.

- Natural gas futures.

- Metal futures.

- Currency futures.

- Cryptocurrency futures.

To be more specific, here are some of the futures contracts available for trading in the financial market:

- Commodities such as corn, soybeans, wheat, oats, rice, milk, whey, butter, cheese, cattle, pork, pork bellies, wood, cocoa, coffee, cotton and sugar.

- Energy contracts such as crude oil, natural gas, electricity and ethanol.

- Interest rates such as Eurodollars, federal funds, 30 Year bonds, 10 Year notes, 5 Year notes, Euro-Bund and Euro-bobl.

- Major metals such as gold, silver, copper, platinum and uranium.

- Stock indexes such as S&P 500, S&P Midcap, Nasdaq-100, Dow, Nikkei 225, CCi, FTSE 100, Euro Stoxx and DAX.

- Cryptocurrencies such as Bitcoin or Ethereum.

Advantages of Operating with Futures

There are several factors that make negotiating with futures trading an increasingly appealing field to make profits.

First of all, you can speculate without being the owner of the asset and the obligation that comes with it. For example, you can speculate with gold or oil without owning these types of assets.

Also, futures trading gives you the opportunity to trade with leverage. Leverage is the ability to control a high value contract with a much smaller investment through the use of borrowed capital.

This gives the trader additional purchasing power and allows them to control larger positions with minimal capital risk.

Another advantage of operating in the futures market is the possibility of trading almost around the clock: 6 days a week and almost 24 hours a day. In addition to this, futures markets are centralized in the Chicago Mercantile Exchange (CME), which means that all participants see the same transaction and volume information.

Last but not least, futures trading consolidate a liquid market, which means that it has a large number of buyers and sellers trading positions; therefore, the market has a large volume of contracts in operation. This facilitates the execution of trades faster and at the desired price.

Risks When Trading Futures Contracts

Although there are many conveniences when it comes to contracting with futures trading, there are also many risks that need to be taken into consideration.

This is why trading is an activity that demands a high level of control of emotions, fears and impulses.

On one hand, there is a high risk when operating with leverage. A high leverage means more risk, because as well as it can result in more income, it can also lead to a high loss.

While leverage is what makes futures trading so opportunistic, it is crucial that traders understand how it works, as well as the role of margins of futures trading.

On the other hand, another risk of trading futures is low liquidity and slippage. Liquidity refers to the number of active participants within a market at any given time.

Some markets have greater liquidity than others. Low liquidity in a market can make it difficult for traders to enter and exit a position at the desired price.

Slippage is the difference between the desired price and the price at which a trade is completed, and most of the time it works against the trader. Slippage tends to occur more often in times of low liquidity.

- It is crucial for traders to understand the dynamics of this activity and set an adequate strategy to make the most out of it. The hardest part is to stick to the strategy when the adrenaline of negotiating kicks in, with real money at stake. This is why futures trading can be a double-edged sword that not everyone can handle.

Because of these risks, in Uprofit we offer evaluation programs for traders who are looking to enter in the world of trading.

This way, they are offered the opportunity to sign up with a pro trading firm that will finance their operations in the futures trading market.

If they manage to pass the evaluation, they get access to a certain amount of money to start operating in the real futures market, when they are considered suitable and ready to start making profits.

Uprofit is a platform designed for traders to be able develop their full potential with trading without putting their own money at risk.

Also, it is an educational site for users that want to enter this world and learn more about futures in trading. Our philosophy is all about benefiting the trader and allowing them to do things in their own, personal way.